OUR

Team

Board of Directors

Leadership

is an action,

not a position

Conrad Dias

Dulip Rasika Samaraweera

Committed to

decisions Flexible

in approach

A Ramanathan

Management Team

Impact

comes from

actions, not

words.

C M Balasubramaniam

The World is changed

by your example,

not opinion

LOLC Group

Always

stronger

T.O.G.E.T.H.E.R

Ishara Nanayakkara

Kapila Jayawardena

Sarajika Sunjeevani

OUR

Journey

From its origins as Sri Lanka's pioneer in leasing solutions, LOLC Group has evolved into a global conglomerate operating across 26 countries and multiple industries, driven by visionary leadership and a commitment to transformative impact.

LOLC’s journey began by addressing the crucial need for financial accessibility for grassroots entrepreneurs. What started as Lanka ORIX Leasing Company transformed into one of the world's largest multi-currency, multi-geography inclusive finance platforms. Today, the Group leads financial services across Asia, Africa, Central Asia, and Australia, with operations in Singapore, Sri Lanka, Cambodia, Myanmar, Indonesia, Philippines, Pakistan, Zambia, Zimbabwe, Nigeria, Tanzania, Malawi, Egypt, Kenya, Ghana, Sierra Leone, Rwanda, DRC, Tajikistan, Kyrgyzstan, Kazakhstan, Maldives, Mauritius, Australia, UAE and India.

The Group's commitment to UN Sustainable Development Goals, client protection principles, and green financing has earned widespread recognition from Development Finance Institutions globally.

With 220 entities, including 18 listed companies, LOLC Group continues to expand its global footprint while maintaining its core mission of fostering inclusive growth and sustainable development. Through innovation and strategic expansion, the group remains committed to creating lasting positive impact across communities worldwide.

LOLC has expanded its impact beyond financial services into other key growth sectors:

GROUP

Achievements

Our Edge In Excellence

We continue to uplift lives globally while realigning our business goals and strategies to improve our service standards for you.

LOLC Group

Company

Profitability

$ 66.5 Mn

Asset

Value

$ 5.8 Bn

Global

Footprint

27+ Countries

Gross

Income

$ 1.1 Bn

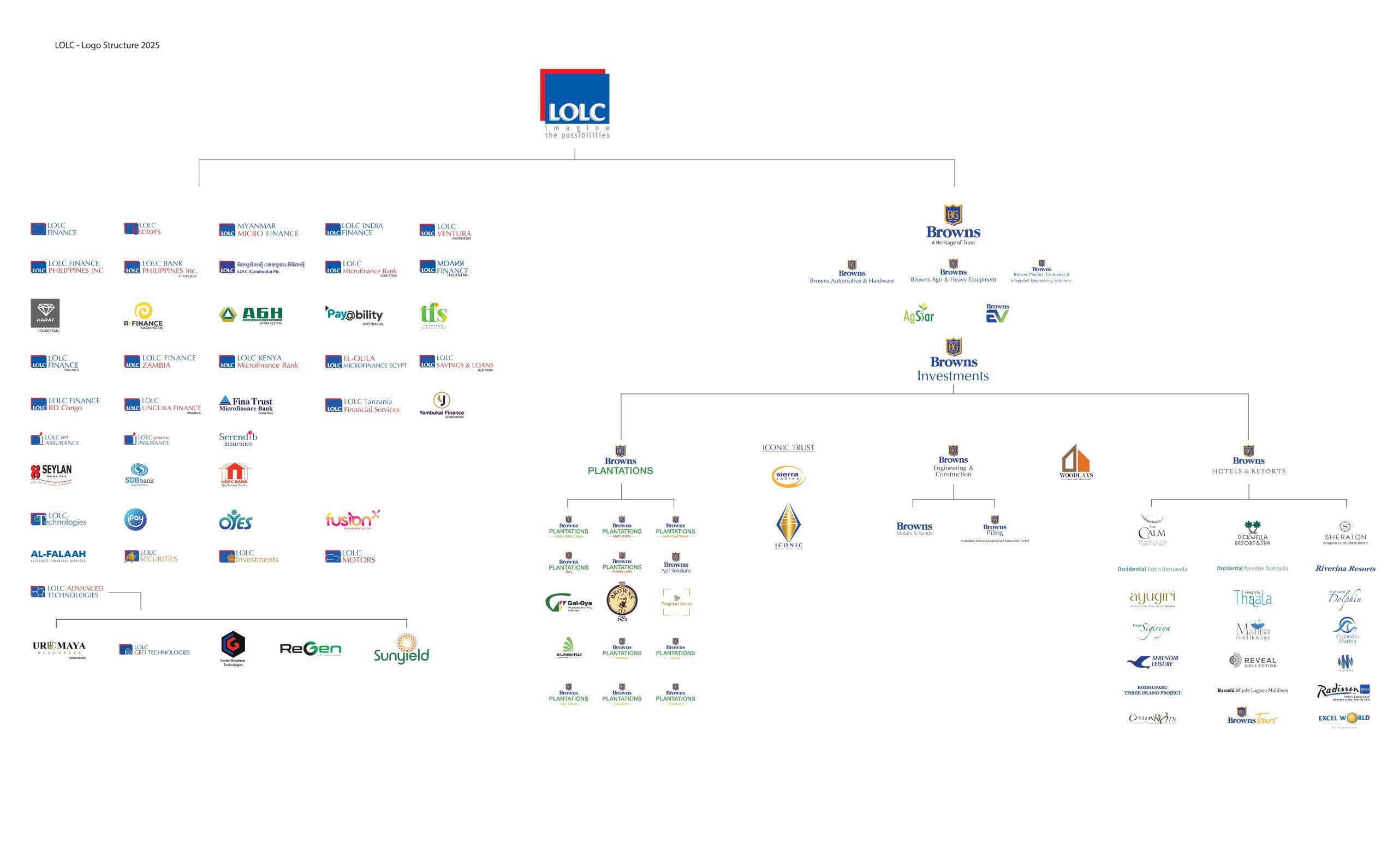

GROUP

Sectors

GROUP

Structure

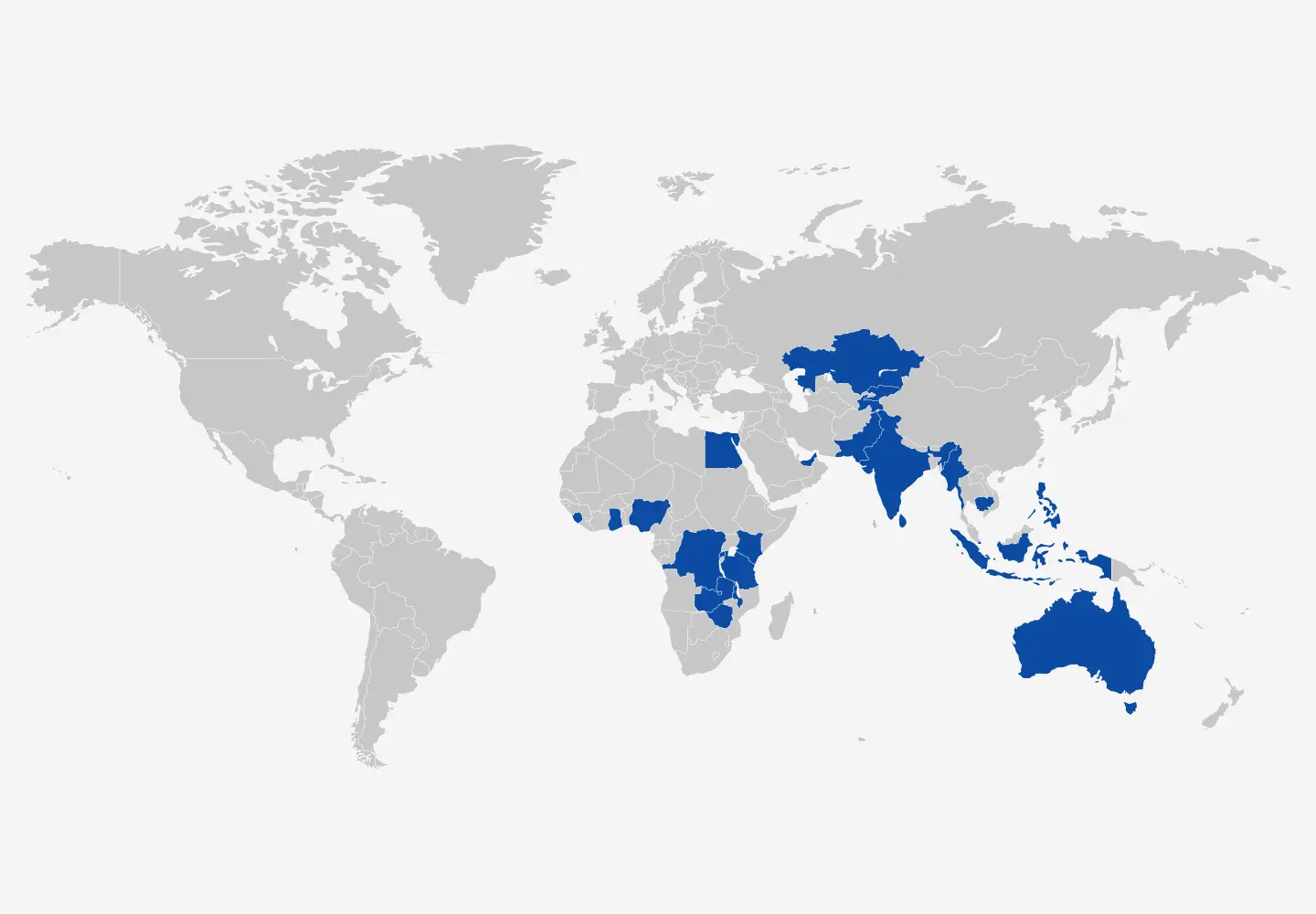

OUR

Presence

- India

- Sri Lanka

- Singapore

- Cambodia

- Myanmar

- Indonesia

- Phillippines

- Pakistan

- Zambia

- Zimbabwe

- Nigeria

- Tanzania

- Malawi

- Egypt

- Ghana

- Ghana

- Sierra Leone

- Rwanda

- Democratic Republic of Congo

- Tajikistan

- Kyrgyzstan

- Kazakhstan

- Maldives

- Australia

- Mauritius

- UAE